Kumpulan Wang Simpanan Pekerja KWSP mengambil maklum cadangan Bank Dunia untuk menaikkan had umur ahli bagi membuat pengeluaran penuh simpanan dalam Akaun 1 dan 2 KWSP daripada umur 55 kepada 65 tahun secara berperingkat. 8 rows There is no change to the current Age 55 Withdrawal.

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Withdraw via i-Akaun plan ahead for your retirement.

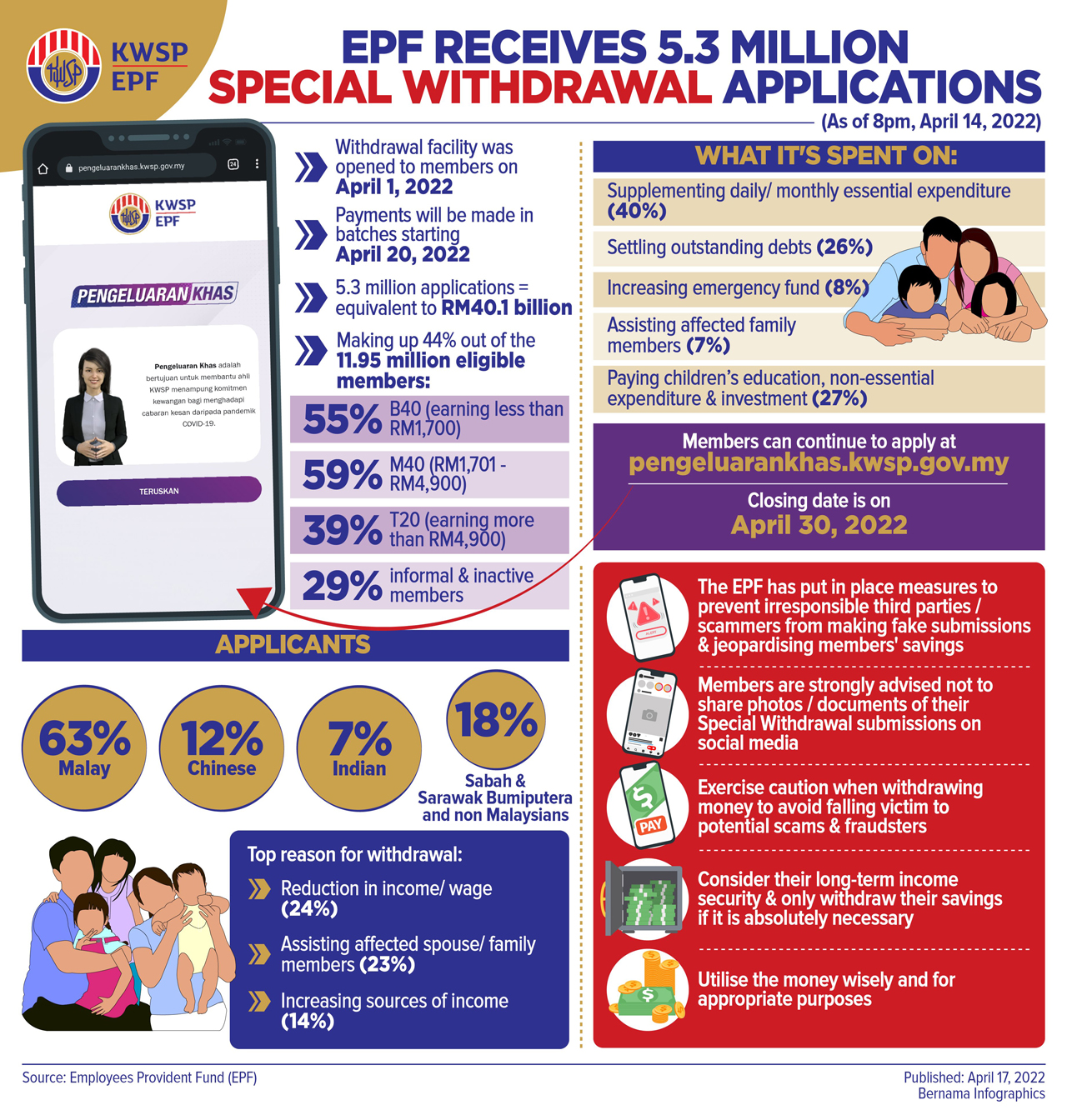

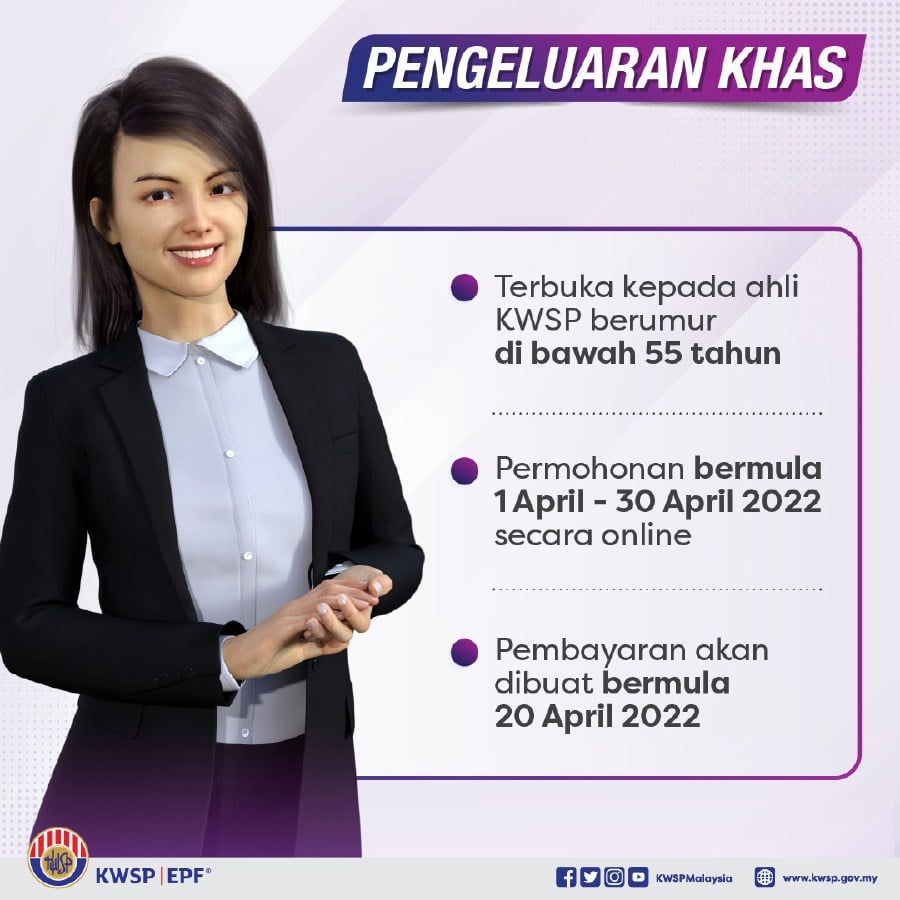

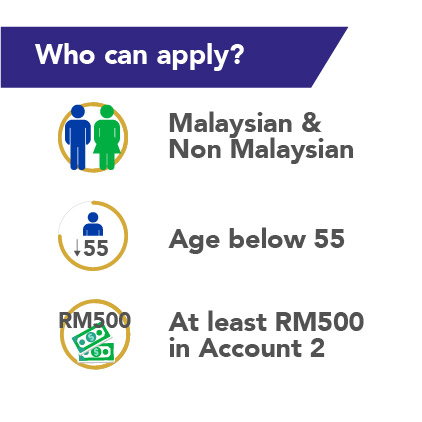

. The EPF however said it has taken note of the World Banks suggestion to gradually raise the age when members can make a full withdrawal of Accounts One and Two of their EPF retirement savings. Members of the Employees Provident Fund EPF who are below the age of 55 can apply to withdraw their savings in the fund from 1 April to 30 April 2022. The EPF assures members that no such steps on raising the withdrawal.

They can perform a lump sum withdrawal monthly withdrawals or partial withdrawal. KUALA LUMPUR 26 Jun 2020. This is opposed to the Age 55 and Age 60 withdrawal policies that allow members to withdraw a minimum of RM2000 once every 30 days.

The World Bank recommends to gradually raise the age when members can make a full withdrawal of their EPF retirement savings from 55 to 65-The Employees Provident Fund EPF today assured members that the issue of raising the withdrawal age has not been discussed with any party at this point in time. Asked on Oct 29 2013 at 0152 by. FULL WITHDRAWAL AT AGE 55 REMAINS.

KUALA LUMPUR 26 June 2020. In August 2015 the hot topics for many Malaysian are on the Enhancement Initiatives of EPF Scheme. What You Can Withdraw.

Can I as a bankruptcy withdraw my EPF when i reaches age of 55 year old. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies. Last updated October 14 2021 EPF or KWSP Retirement Planning.

Monday 04 May 2020 1000 AM MYT. Since I was bankrupt i did not seek for the insolvency department because i do not have money to pay them. Jumlah pindahan minimum RM100000.

Have savings in Account 2. Full withdrawal at age 55 remains. Public sector employees can make a one-time withdrawal of your share of contributions before age 55 upon granted of Pensionable Employee status.

The Employees Provident Fund EPF today assured members that the issue of raising the withdrawal age has not been discussed with any party at this point in time. Withdrawal from both Account 55 and. The EPF assures members that no such.

Should you choose to continue working after the age of 55 all further contributions you make will be credited in your Akaun Emas to be withdrawn only upon. Refer to the list of EPF panel banks for direct. You can withdraw from your EPF to cover house down payments principal repayments and even.

You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. EPF withdrawal - Age 55. Upon reaching age 55 the contributions made to your Account 1 and Account 2 will be consolidated into Account 55.

EPF Full Withdrawal Age Stays at 55. The retirement fund said the services can be done at branches located within states that are. Pengeluaran Umur 60 Tahun Pelaburan Permohonan pada bila-bila masa.

Perlu mengekalkan simpanan minimum RM100000 dalam Akaun 55 jika adaAkaun Emas. Im 25 yo and I want to seek some advice here. Prime Minister Datuk Seri Najib Razak has affirmed that Employees Provident Fund EPF members will be able to retain their rights to withdraw their savings at the age of 55 following public uproar over the retirement funds proposal to increase the full withdrawal age limit from 55 to 60.

EPF Withdrawals for Housing. Further details will be announced by the EPF on its website or social media platform. Entire savings in Account 2.

You can withdraw all or part of the savings from this account at any time. The EPF however said it has taken note of the World Banks suggestion to gradually raise the age when members can make a full withdrawal of Accounts One and Two. The Employees Provident Fund EPFtakes note of the World Banks suggestion to gradually raise the age when members can make full withdrawal of Accounts 1 and 2 of their EPF retirement savings from 55 to 65.

Permohonan secara dalam talian melalui i-Akaun Ahli. KWSP ingin memaklumkan kepada ahli bahawa pada ketika ini tiada sebarang perbincangan. Aged between 50 and before reaching the age of 55.

Tempoh bayaran minimum 6 bulan dan maksimum 12 bulan. Now you can withdraw all your EPF at age 55 while you are still working with someone else if you choose to retire at later years say at age 60. KUALA LUMPUR June 26 The Employees Provident Fund EPF today assured members that the issue of raising the withdrawal age has not been discussed with any party at this point in time.

When you reach a certain age owning your own home will be high on your list of things to do. Members who choose to make monthly withdrawals will also be able to withdraw from as low as RM100 per month a reduction from RM250 currently. My parents just quit their jobs this year and me and my brother are paying 50 50 for all the expenses.

When members turn 55 they can make withdrawals and have access to savings in Akaun 55 anytime. Upon reaching age 55 your savings in Akaun 1 and Akaun 2 will be combined and put into this account. Full withdrawal at age 55 remains Malay MailKUALA LUMPUR June 26 The Employees Provident Fund EPF says it has taken note of the World Bank s suggestion to gradually raise the age when members can make a full withdrawal of Accounts One and Two of their EPF retirement savings from 55 to 65.

KUALA LUMPUR May 4 The Employees Provident Fund EPF will be resuming Age 505560 Withdrawals and mobile i-Akaun activation services beginning Wednesday May 6 at approved branches throughout the country. 601 Views Asked 8 Years Ago. Im a programmer that work from home where my salary is 4k per month.

The government is not implementing the Employees Provident Fund EPF withdrawal at age 60 for private sector employees although the minimum retirement age has been extended to 60 years effective. You have the option to withdraw EPF savings at age 50 or 55 either partially or fully or at age 60 when you can then withdraw any amount at any time. Among the initiatives is to raise the EPF full withdrawal to 60 from the current 55 years old.

Withdrawal from Akaun 55.

Epf The Withdrawal Syndrome The Star

Epf Withdrawals Before Maturity Personal Finance Retirement Withdrawn

Epf Withdrawals Of Rm101b Will Not Affect Domestic Financial Markets Mohd Shahar The Star

The Rundown On Epf Withdrawals

.png)

Epf Special Withdrawal How Will This Effect Us

Additional Epf Withdrawals Can Cause Retirement Below Poverty Line Says Finance Minister The Star

Withdraw All Your Epf At Age 55 While Still Working Until 60 Tax Updates Budget Business News

Further Epf Withdrawals Will Burden Younger Generations In The Future

Rm10 000 Epf Withdrawal Now Will See Greater Financial Loss News Mysinchew 星洲网 Sin Chew Daily Malaysia Latest News And Headlines

Withdrawing Your Epf Savings Early Here S What You Need To Know

Epf Special Withdrawal Payment From April 20 Onwards

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties